The biopharma industry in Massachusetts showed promising signs of recovery in 2024, a year marked by the growth of venture capital (VC), a revival in initial public offerings (IPOs), and many mergers and acquisition (M&A) activity – especially in early 2024. , according to MassBio’s new report at the end of the year. For the first time, the report also found that private biopharma companies based in Boston raised more venture capital than their Cambridge headquarters, a record we’ll be watching closely this year for signs of a trend.[BB1]

MassBio’s head of external affairs Ben Bradford said The Boston Globe “2024 showed us that the industry is coming back,” citing a pickup in IPOs in 2024 and nearly half-a-billion dollars in venture capital raised by local companies in the first week the new year “green fruit. .”

2024 Venture Capital Funding: Welcome Welcome

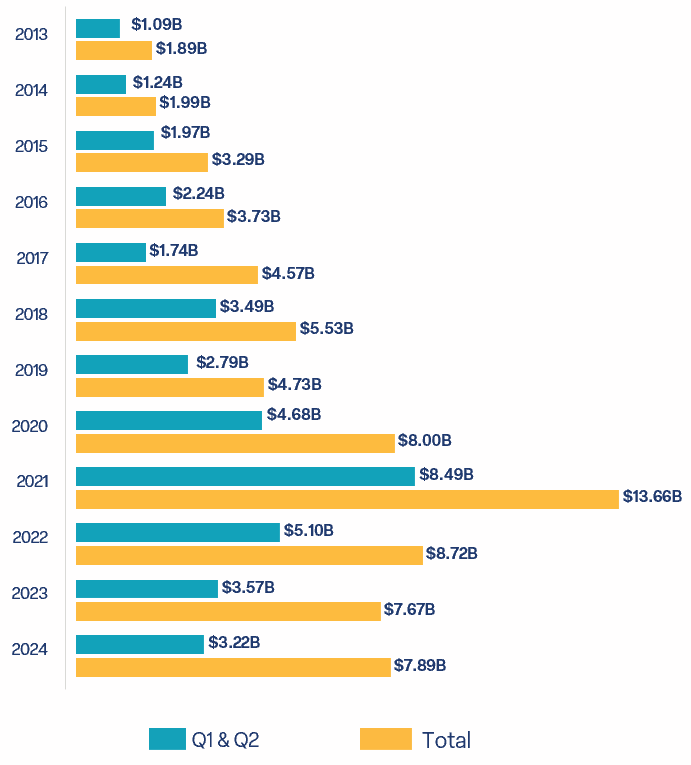

One of the most notable developments in Massachusetts’ biopharma sector in 2024 is a small but meaningful increase in capital investment. Massachusetts-based companies recorded $7.89 billion, up from last year’s total of more than $220 million. This marks the first increase in funding since the 2020-2021 fiscal year. However, the continued increase in megaarounds, means that we have to meet the expectations of a general renewal of investor confidence.

Massachusetts-based companies received 28.3% of the nation’s VC dollars, second only to California (41.6%). Although New York came in a distant third with 6.6%, North Carolina and Texas were right up there with the Empire State. It is certain that these two states are positioning themselves as new places with low costs of living, something to watch closely as the debate continues on the competition.

A significant trend continued in terms of the business community in Massachusetts, with 72% of business funding going to companies based outside of Cambridge. Although Cambridge had more deals than Boston (73 vs. 62), Boston led the way in VC funding, securing $2.3 billion compared to Cambridge’s $2.2 billion. This change indicates that private companies are growing in Boston’s Seaport and nearby suburbs such as Watertown, Waltham, and Burlington, but Cambridge it is still a hub for startups and many pharmaceuticals.

“Not only is biotech back, but Massachusetts is leading the recovery and return to fundamentals investment in following the best research on the way to patients,” the said MassBio CEO and President Kendall Burlin O’Connell. “We saw venture capital investing in startups with proven track records and medical companies acquiring and partnering with companies with pipelines. We also witnessed the maturing of a cluster, with Boston staking its claim while the location of the growing company is to advance to the hospital.

Communication and Marketing: A Rapid Increase

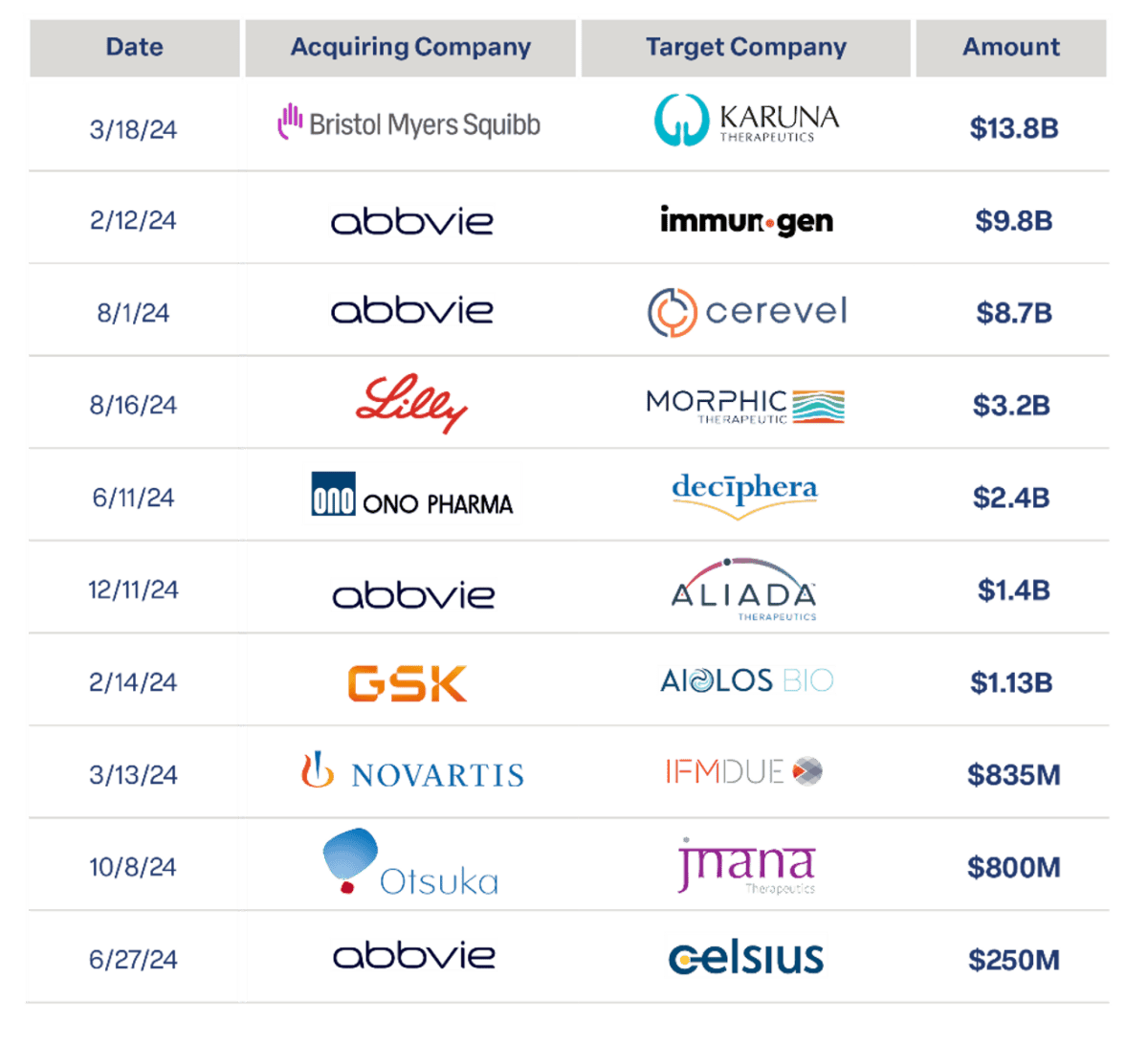

Medical companies started 2024 with an explosive quarter for mergers and acquisitions, especially in the first quarter. In total, 15 of the 32 deals involving Massachusetts companies were announced between January and March, about half of the year’s total. Although the number of M&A transactions fell by six from 2023, the total value increased to $ 42.6 billion – from $ 13 billion in the previous year.

Bristol Myers Squibb’s $13.8 billion acquisition of Boston-based Karuna Therapeutics was the biggest deal of the year. The discovery quickly paid off when the FDA approved Karuna’s schizophrenia drug, Cobenfy, just six months later. It is the first new treatment for schizophrenia in years, providing another option for patients who previously did not want to take medication because of the side effects. Massachusetts-based companies led acquisitions, with the sale of Alpine Immune Sciences (Seattle, WA) to Vertex Pharmaceuticals topping the list at $4.9 billion.

Despite the increase in transaction value, the overall volume of M&A transactions slowed at the end of the year. This year, we saw a few deals announced at the start of the JP Morgan Healthcare conference in San Francisco, including two acquisitions of Massachusetts-based companies, but only time will tell if it marks another quarter. first force in 2025.

IPOs: The Most Open Window

Public markets saw improvement in 2024, with Massachusetts biotechs completing six IPOs, tripling the number from last year. In particular, Bicara Therapeutics (Boston), Zena Therapeutics (Waltham), and Upstream Bio (Waltham) raised the most from their IPOs. However, the uncertainty of the market was confirmed, because the sales prices of five of these companies are trading below their initial prices at the end of the year. Only Rapport Therapeutics posted modest earnings, indicating that while investor confidence is returning, conditions remain subdued. uncertainty.

Of the GlobeLarry Edelman said that “fiscal and regulatory issues, including high interest rates and uncertainty about President-elect Donald Trump’s health care policies” explain why biotech stocks underperformed last year despite other signs of recovery.

Update on Topic: Drug Development Continues

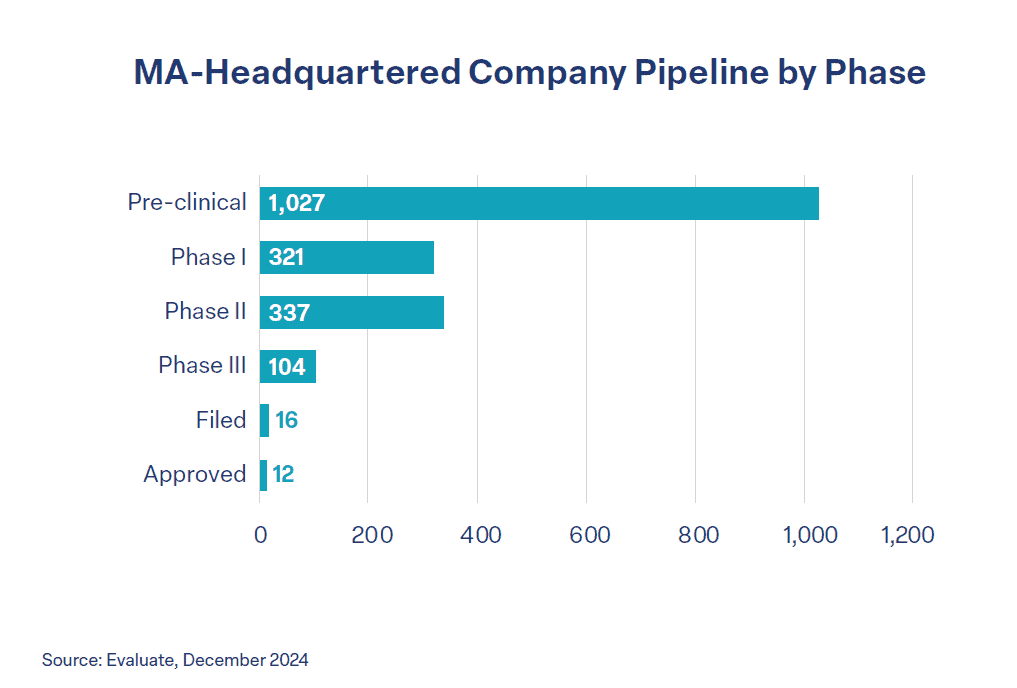

Despite the financial ups and downs, Massachusetts’ biopharma sector remains a force for innovation. Local companies are actively developing more than 1,800 pharmaceutical sales representatives, representing 15.1% of the US pipeline and 6.4% worldwide. In 2024 alone, 23 companies based in or with significant value in Massachusetts received FDA approval for ground-breaking treatments for diseases such as RSV, schizophrenia, and leukemia.

The success of the industry depends on continued investment in start-up companies—fires are the most dangerous science and can cause accidents. That’s why early support is a key priority for MassBio’s Vision 2030 strategic plan. With the Legislature’s approval and Governor Healey’s signature on the new Massachusetts Life Sciences Initiative (LSI) through the next decade, the state is well positioned to build on its strong.

Looking ahead: 2025 and beyond

Like the Globe’s Larry Edelman reminded us, “Biotech is a risky business. The average cost of developing a new drug is almost $900 million. Nine out of 10 never make it to market. But the Massachusetts biotech sector has been a reliable engine of the economy even in tough times. That won’t change anytime soon.”

The outlook for business in the country, according to some experts, remains cautiously optimistic. A recent article on Nature Biotechnology pointed out that while the recovery of 2024 is a good sign, the biotech industry in 2025 is likely to be more of a “transformational year.” However, PharmaVoice wrote in their own predictions that, after a year marked by the smallest number of trades and the most accurate data, the economic conditions may be ripe for a stronger M&A environment to fill gaps in research and development.

While PharmaVoice point to oncology, obesity, immunology, and neurology as medical areas likely to reap the most R&D dollars, the move to specialty medicine and continued progress in gene development is also expected to promote growth. According to FierceBiotech2025 is likely to see an increased focus on rare disease treatments and precision oncology, with major biotech centers like Massachusetts at the forefront of these innovations. In line with what MassBio has demonstrated in the development of our Plan 2030 strategic plan, the continued discovery of innovative pharmaceuticals AI and advances in mRNA technology will drive new medical developments, creating exciting opportunities for Massachusetts biopharma and technology companies.

Massachusetts continues to focus on fostering diverse startups and foundations, with the state’s combination of talent, research organizations, and biopharma companies, positioned to maintain its leadership role in the healthcare sector. for years to come.

“With a Life Sciences Initiative in hand, and our own MassBio Vision 2030 roadmap to follow, you can count me among those who are pushing for local businesses in the coming year, ” added Burlin O’Connell.

See all MassBio News

#Massachusetts #Biopharma #Signs #Recovery #Growth #Uncertainty #MassBio